In my last post have discussed about the Magic of Compounding in Investments and how we can build a fortune by concentrating more on the time factor rather than the return factor. Simple equation is start early, focus on increasing the time horizon and you can easily become Wealthy. If it is so easy, why doesn’t everyone focus on these factors and get rich? well, there are few distractions we humans face and will write about those in this one, you can also read my blog Simple but not easy here which discusses about the distractions from external factors.

- Spend more than you Earn –

The basic formula for saving that people understand is that Income – Spending = Saving, which is a sure-shot way to financial disaster. The correct formula should be Income – Saving = Spending. You have to be frugal to not spend all the money you earn. Frugal doesn’t mean that you have to buy cheap products, cut all expenses etc. You just need to think before spending. Money is finite and it’s important to make wise choices with this limited source. Once you spend whatever you have you won’t have more to spend.

- Getting into High cost Debt-

By high cost debt i mean Credit Cards, Personal Loans etc. the interest you pay for getting the same is so huge that if you are not disciplined you are sure of going broke. Getting Loan to acquire some assets is fine, and even here please ensure that, whenever you get some surplus you need to make some payment to your loan account and get rid of the same.

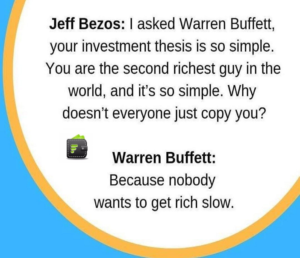

- Being Impatient-

To move ahead in your financial life you need to be very patient. No matter how great talents or efforts you put things take time to grow. Ensure that you have a strong foundation for your Financial Goals, once this is taken care of the growth comes automatically. Just read how bamboo tree grows, same is with the investments. The initial corpus is very tough to generate or accumulate and once this is done leave the rest to the Magic Formula .

- Be Financially Intelligent –

I am not asking you to join some finance course here, just go through some basic of financial instruments. Get to know the basic features of various asset class and read more about Behavioural finance you are done. You must have basic financial intelligence because a fool and his money everywhere. You must have the ability to differentiate between needs and wants and cut the latter short. A lot of success in Life and Investments comes from knowing what you want to avoid – Charlie Munger

- Avoid Impulsive Buying-

Impulse buying is an unplanned decision to buy a product or service, made just before a purchase. When you take such buying decisions at the spur of the moment, it is usually triggered by emotions and feelings and will surely lead to a disaster. Whatever you want to buy, plan in advance accumulate the required money for it and purchase. Create an Reverse EMI fund, use this fund to buy the required stuffs for your home or your personal consumption, this is a wise option to practise rather than to buy things on EMI.

Happy Investing!

R♥Vi

Be First to Comment