We all are aware that what Covid19 pandemic has done to the stock markets worldwide including Indian markets. Sensex and Nifty after coming off their highs and hitting multiyear low on 23rd march, had a sharp rally of around 20%. Though no one is sure where the markets are headed, but i can say with certainty that, this fall has made valuations pretty attractive. Going by the past history, markets have always rebounded after hitting these levels. It doesn’t mean that markets won’t go down; in the short term anything can happen but for 5 years plus this level is a good entry point.

Now the major question is Should I invest in Large cap or Mid-cap or Small cap funds?

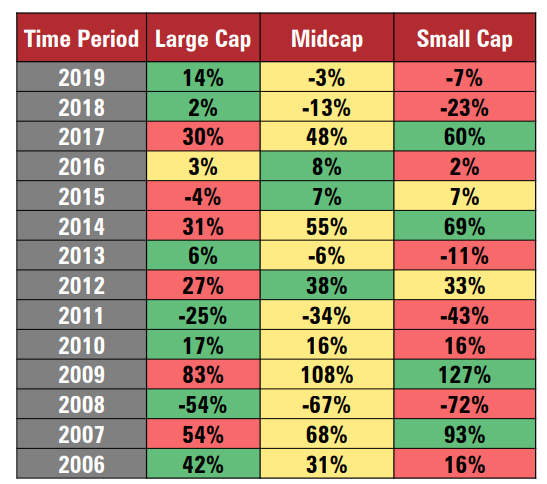

Below is the performance history of the Large, Mid and Small cap indices in the past.

Except for few years, rest of the times the divergence in performance is very significant. So there is no clear trend even during normal years, what will happen now?

Well, again if we dig some past records on how the markets behaved after every correction, the outcome is, if you had invested around the bottom of the markets, midcap and smallcap indices has outperformed the large cap index. But, how do we know that this is the bottom, it’s very hard to predict, especially during these uncertain times, where the whole world economy and its businesses is shut for weeks together.

Now the other scenario, assuming that you had invested few months before the actual bottom or few months after markets forms a bottom and goes up, there is no clear winner. On some instances, large cap outperforms and some instances midcap outperforms and small cap on some instances. It gives us a very confusing trend, you cannot even shun away from investing as there are no better options available and the most important thing is what will happen to some poor souls like me? So here is a solution:

If you are a conservative investor and not ready to take huge volatility but okay with short term under performance, invest in Large cap funds. If you can take slightly higher amount of risk, you can expose your investments to Mid and Small cap funds.

If you cannot decide on the above options, then one category of funds which suits your risk profile is Multicap Funds or even Large & Midcap funds. Multicap funds have exposure to Large, Mid & Small cap stocks and the other one have exposure to Large & Midcap stocks. The actual allocation within this universe might vary depending on the Fund management Style of the Mutual Fund. But when we don’t know which set of stocks going to perform, it’s better to diversify and invest in Multicap funds. Which Multicap funds to invest in? will do in the next post, till then ♥.

Happy Investing!

RaVi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Be First to Comment