CRISIL & AMFI has recently released some important data’s pertaining to the Mutual Funds Industry. One interesting data which I really liked and wanted to share the same, which, I feel would be more useful for the MF investors at the current juncture.

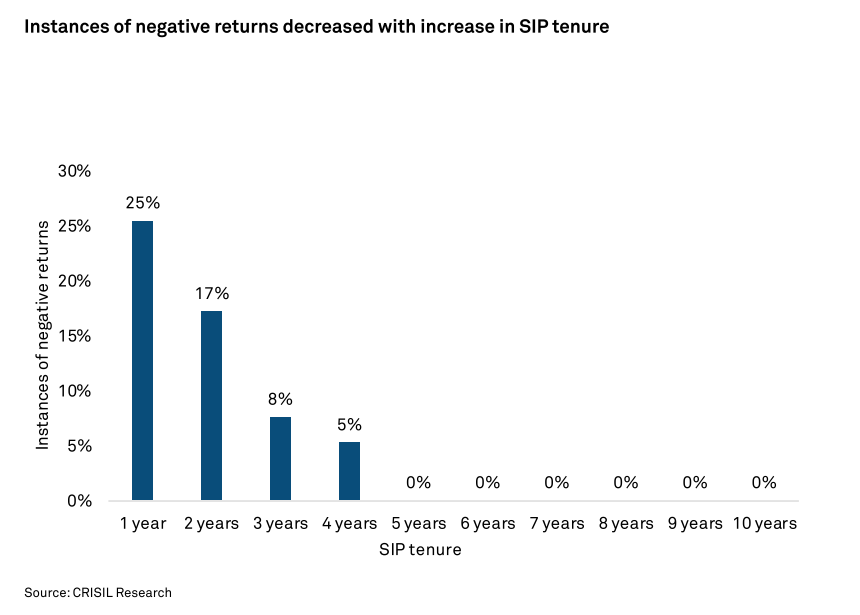

The data is all about the probability of getting negative returns from your SIP investments for different investment horizon.

So according to their report, though the chances of getting negative returns is very high in the 1 year and 2 year horizon, from the 3rd year onward the chances are very less and its zero from the 5th year. Some key points I can infer from this data are:

- If you are planning to invest for more than 5 years and you have the risk appetite for equities then SIP will be the best option. And if you do not want to invest in equities you can always look at other conservative schemes, like Hybrid or Asset Allocation funds.

- Also one big advantage of investing during down time is, you get more units for the same amount of Investment, that’s the advantage of SIP (rupee cost averaging)

- Irrespective of your risk profile and market condition, if your investment horizon is less than 5 years please do not invest in Equity Mutual funds, either through SIP or STP or Lumpsum.

This data is for the period of past 15 years ending June 2019, i.e. from June 2004 to June 2019. And during this time, we have passed through some of the worst crisis like Sub-Prime Mortgage, Banking & Credit crisis (Lehman), Euro zone problem, Federal Reserve to taper stimulus, Chinese Market Selloff, Brexit, US Presidential Election, Trade War etc.

There is one more important chart, explaining the advantage of Compounding in Mutual Funds.

So, with the increase in the time horizon of investments, you tend to get more returns. The difference of returns may be very less between 3 and 5 years, but if you take 3 & 7 years or 7 & 10 years, the difference is significant. That’s the compounding factor helping your investments to get more returns.

So the point is, no matter the level and frequency of negative news flows around us, start early, pick correct asset based on the time horizon and keep investing, following these simple rules will take you closer to Financial Freedom.

![]()

Fund Wallet for Financial Freedom

Happy Investing!

RaVi

Mutual Funds Investments are subject to Market Risk. Past returns are no guarantee for the future.

Source:Crisil, AMFI

Be First to Comment