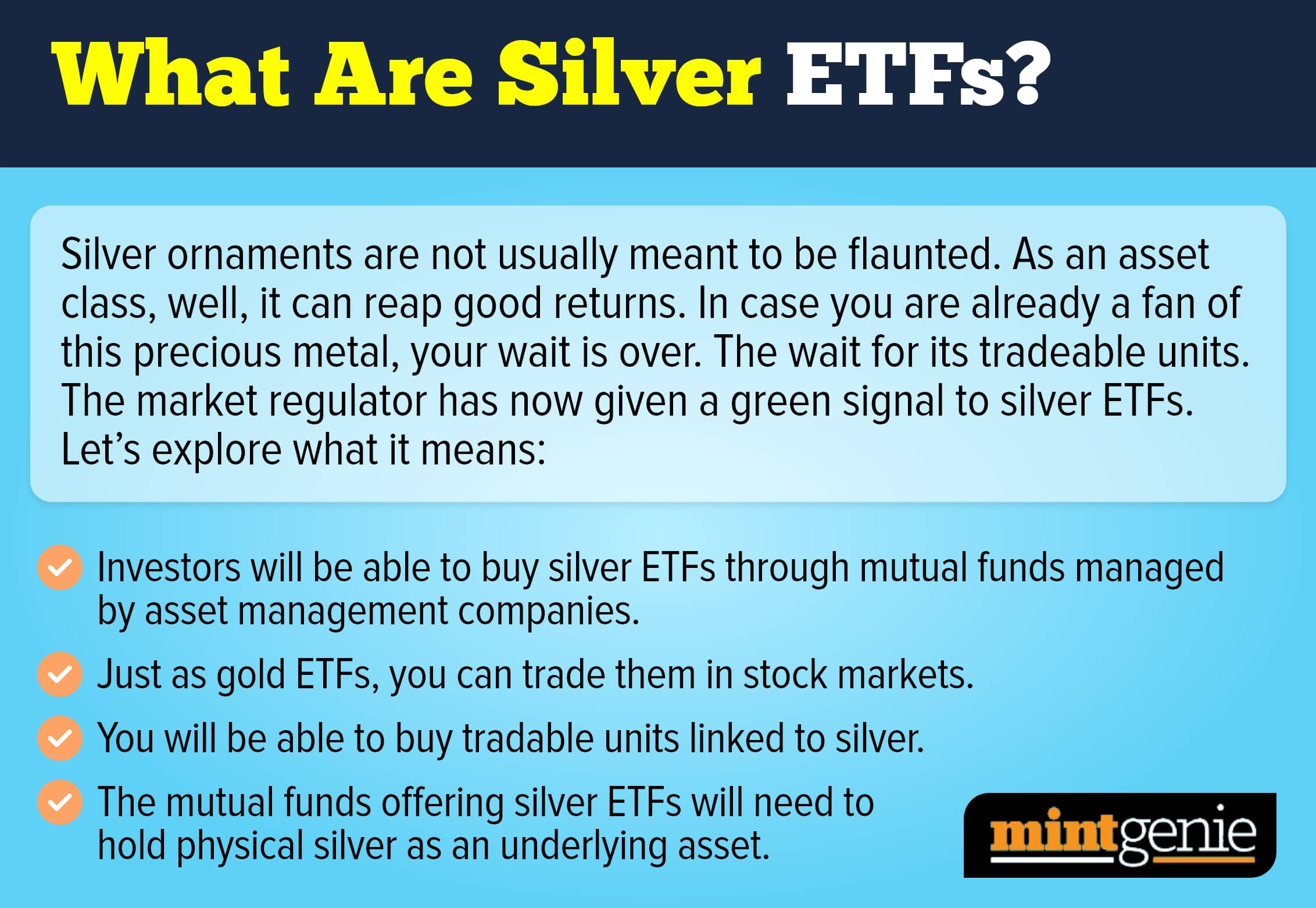

DSP Mutual Fund introduced a NFO (new fund offer) called DSP Silver ETF (exchange-traded fund), which will invest in silver and silver-related instruments. This new ETF offers an easier way to buy or sell silver compared to the physical version with the freedom to trade easily.

Silver Exchange Traded Funds

Silver has various industrial applications in addition to being a valuable metal. It is in high demand in the industries of manufacturing, investment, and jewellery. More than half of silver is used in heavy industry and high technology, according to the world silver survey study.

Fund Features

- Silver can be a good diversifier in volatile times since commodity price movements have a low correlation with equities.

- Far easier to ‘keep’ or ‘sell’ this version of silver when compared to the physical version, with the freedom to trade actively with ease.

- Silver, as a commodity, has delivered around 12 percent returns on a 5-year rolling basis, as per fund house.

- Around 50 percent of the world’s silver is consumed by electronics, auto, power, pharma and many other industries but the supply & availability for recycling is limited. As the world shifts to renewable & cleaner energy resources, there is potential for demand to go up since silver is a crucial raw material.

- In silver ETF format, investors can buy this precious metal with just Rs. 5000, instead of spending a lot on expensive jewellery items, according to the press release.

However, investing in silver is a high-risk strategy and is more suited for experienced investors who understand precious metals or commodities cycles. Investors must be prepared to face short-term fluctuations and stay resilient through such times, the fund house added.

Happy Investing!

RaVi

This is not a Recommendation. Fund Wallet is a AMFI Registered Distributor of Mutual funds. Source- DSP MF & Mint

Be First to Comment