Market Wrap

Indian equity markets witnessed a sharp rebound in April, 2020 from four-year lows witnessed in March. The Reserve Bank of India (RBI) announced a slew of measures in mid-April to counter the ensuing economic downturn from COVID-19, with the Governor reinforcing the notion that the RBI will do “whatever it takes”.

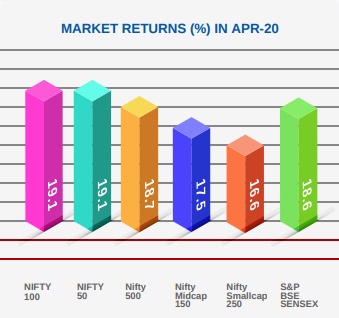

The RBI reduced the reverse repo rate by another 25 bps (after the 90 bps in end March) to 3.75% to further incentivize banks to lend. Nifty 50 and S&P BSE Sensex ended the month of April with 14.7% and 14.4% returns, respectively. Indian domestic market (Sensex) outperformed peer group MSCI Emerging market (9%). BSE Midcap and Small cap indices ended with 13.7% and 15.5% returns, respectively

Global equities witnessed a sharp recovery, as central banks further expanded stimulus plans coupled with flattening of COVID-19 infection curves across countries. Market sentiment was further buoyed by Gilead’s announcement of positive data from phase-3 trials for antiviral drug. Worldwide, all major indices closed in green. Dow Jones was the out performer with 11.1% returns, followed by Nikkei (6.7%), Euro (5.1%), and Hong Kong (4.4%).

Sector Performance – Healthcare was the best performing sector with a gain of 26.2%, outperforming the Sensex by 11.8%. Auto (24.2%), Oil and Gas (20.4%) and Metal (18.1%) sectors outperformed the Sensex. Banks (12.1%), Tech (11.7%), Capital Goods (11%), IT (10.8%) and Power (8.2%) sectors underperformed the Sensex. Realty, Consumer Durables and FMCG were the worst performing sector with 7.1%, 6% and 5% returns, respectively.

COVID-19 has wider implications on economies and businesses across the globe. However, the impact will vary depending on the sectors, as companies operating in essential products are less impacted and will see faster recovery, low inflation, which has got further tailwinds in the form of lower crude oil prices will surely help in our recovery. Given the COVID-19 disruptions in the first 3 months and expected gradual recovery in the remaining months of the fiscal year. Post Pandemic companies with core competitive advantage, strong balance sheet and ability to sustainably generate cash flows will surely emerge much stronger.

Happy Investing!

RaVi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Past performance may may not happen in the future

Be First to Comment