Compounding is the Magic Formula which if understood and executed well gives you the foundation for building your fortune.

Time mixed with the power of compounding is the most potent combination for wealth creation.

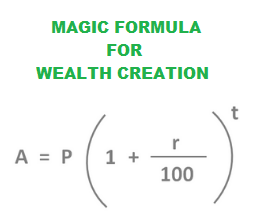

Compound interest allows you to grow wealth faster by earning a return on your past returns, instead of you working for money the money you saved and invested will work for you.This isn’t a linear relationship – it’s exponential. The human brain isn’t good at visualizing exponential things, which may explain why it’s so difficult to fully appreciate a plan that fully leverages the power of compounding. The recent example is the rate of growth of COVID 19 cases. Ok, now let’s come to the formula:

This is the formula for Compounding, A in the formula is the End Amount, P is the investment amount, r is the Rate of Return and t is Time Horizon (number of years). This will look as a simple formula and you might think what is so great about it, that’s natural. Will explain you what mistake we make while interpreting this simple formula.

The Primary part is A, we need to identify our goals and calculate what is the requirement corpus for the same, why should one do this? we can just start investing what ever surplus we have an be happy with it, but once you identify your goals and map each investment with that particular goal we won’t think about breaking that Investment. Imagine you start investing for your kids education, whenever you feel like breaking that investment for some other requirement your mind would not allow you to do that.

Second factor is P the Investment Amount, the habit of saving and investing for your needs and goals need to be prioritized. If there is no P then there is no point of calculating A. So, one need money to make money, but that money can be even small to start with and gradually increase.

The next factor where most people are obsessed with is r (rate of return), be it an experienced investor or an novice the first question they ask is what is the expected return for the investment? again its human brain nothing can be changed about it. The attitude here is higher the r quicker the appreciation, and with more emphasis on this r we tend to forget the other bigger R which is Risk and get struck in some dud investments. We lookout for high yielding investments because it will reduce the burden of P. We also fail to understand that r depends on the asset class we invest in (Debt or Equity), r is not constant it varies every year.

The most important factor in the formula is t (Time horizon) which is least understood and taken into consideration. The time you spend in the market decides on the returns you get and not the r. The exponential factor in our investment is fueled by t and not r, because r varies with the Asset class we choose and its normally volatile in the short term. Compounding effect will take time, it will look very minuscule in the initial years but once you cross 7 or 8 years of regular investment the compounding takes charge of your returns and not the r.

Small Decisions and Good Habits Lead to Big Results

It’s simple to achieve financial success if you can make decisions that take advantage of the power of compounding over time.Whether you’re saving early and often, systematically adding to your investment portfolio, or staying the course in times of uncertainty, time has the power to turn small habits into incredible results.

The decisions you make today will have compounded effects decades later. But before you can start making good choices, you first must take time to figure out what you’re trying to get out of your Investments.

Happy Compounding!

R♥Vi

Be First to Comment