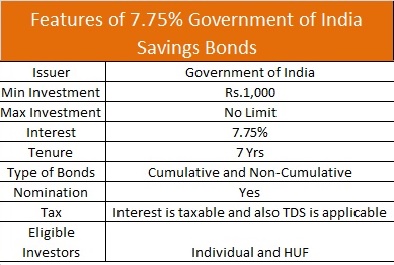

Government of India Savings Taxable bonds offering Interest Rate of 7.75%, what else do you want at the current scenario. If you are okay with 7 years of lock-in, you must not have any second thoughts to invest in these bonds. First, its backed by Government so no credit risk, Interest rate which is higher than even some of the reputed NBFCs.

The bonds are issued only is Demat form.

Nomination facility available.

Cumulative and Non cumulative option available. Interest to the holders opting for non-cumulative Bonds will be paid from the date of issue up to 31st July OR 31st January as the case may be, and thereafter half-yearly for a period ending 31st July and 31st January on 1st August and 1st February.

You cannot change from Cumulative to Non cumulative or vice versa in the middle of the tenure.

Though the tenure of the Bond is 7 years, premature withdrawal is available by submitting necessary documents:

(1) Lock in period for investors in the age bracket of 60 to 70 years shall be 6 years from the date of issue.

(2) Lock in period for investors in the age bracket of 70 to 80 years shall be 5 years from the date of issue.

(3) Lock in period for investors in the age of 80 years and above shall be 4 years from the date of issue.

In case of joint holders, the above lock-in period will be applicable even if any one of the holders fulfills the above conditions.

Interest income is taxable and TDS will be applicable.

It can be bought through most of the Public sector banks and selective Private Banks and NBFCs.

Please call or write to me if you need any further details.

Happy Investing!

RaVi

Be First to Comment