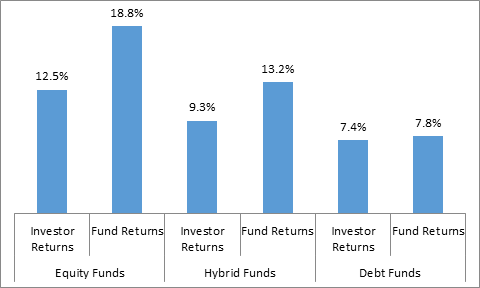

Going by the topic if you think that we get lesser returns due to Expense or Tax, sorry it’s not. Few months back i read a report by Axis Mutual Fund, that Investors get less returns than the Fund returns and was furious to know the reason. Below is the snapshot of the report:

Axis Mutual Fund has conducted a survey about how Investors’ Behaviour affects their investment returns, the survey have given some interesting facts. They have found that investors have earned return of 12.5% between September 2014 and September 2019 while the fund delivered return of 18.8%, 6% lower. This lesser yield than fund has nothing to do with charges or load etc, its largely due to frequent churning of their investments. This is with regard to Equity Funds, For hybrid funds, investors earned 9.3% return while fund returns came to 13.2%.

In debt funds, though the Investor returns was lesser than the fund, but only marginally. While fund delivers 7.8%, investors got 7.4%. The report analysed data between 2009 and 2019 for debt funds.

So, the lesser returns is due to frequent churning by investors. Frequent churning is due to overreacting to short-term market noise, selling in Panic. The other major factor for churning is, most of them focus on short-term performance and take some decision. If they see any of their holding under performing for few months, they normally have a tendency to jump the boat.

To realize higher returns, the report recommends investors to stay disciplined by investing regularly, start investment as early as possible and focus on long-term fund performance rather than getting swayed by ongoing market fluctuations.

Below is the Methodology:

The analysis used regular growth plan returns for all actively managed diversified funds for which data was available during the period. All analysis was done using monthly AUM and return data.

Equity funds: all open-ended diversified funds for which data was available during the period.

Debt funds: All open ended debt schemes excluding liquid, ultra-short term and gilt schemes for which data was available during the period

Hybrid funds: All open – ended hybrid schemes including MIP, balanced and other asset allocation schemes.

Fund Returns: Fund returns represent the asset weighted returns for all funds.

Happy Investing!

RaVi

source: cafemutual

Be First to Comment