DON’T LET MARKET NOISE AFFECT YOUR SIP INVESTMENTS

The market volatility brought on by the COVID-19 pandemic has hit the visibility of returns from Mutual Funds for Investors, but an old adage rings true now more than ever – fortune favours the brave. And for investors in systematic investment plans (SIPs) of mutual funds, the intrepid move would be to stay the course than pause or exit.

Indeed, a CRISIL analysis shows that despite the weak or negative returns seen in five to seven-year SIPs recently; pulling out at this stage would be counterproductive. If you are someone facing this issue, my advice would be to stretch the investment horizon slightly more, and prospects brighten for optimum returns. Let’s see with an example:

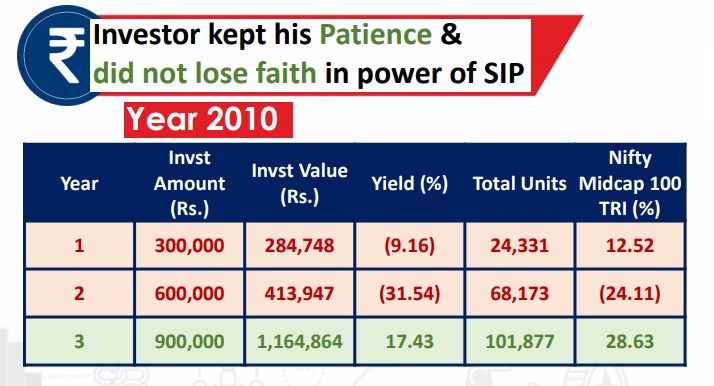

Assume that you start an SIP in a Diversified Midcap Equity fund during the peak of 2008, first two years would have been a washout , but if had continued SIP for one more year, the next year you would have not only recouped the loss of the previous years, but have also made some handsome returns.

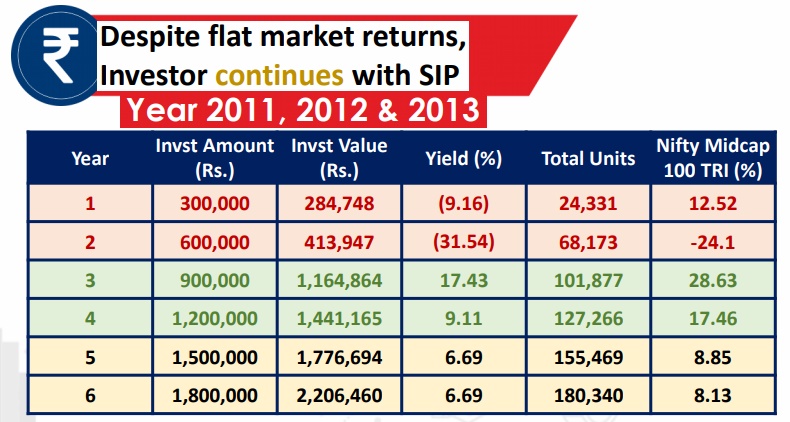

Now, you have got your conviction back and decided to stay invested for few more years and make more returns out of your SIP.

So first two years the investment saw negative returns, next two was extremely positive and the next was just flattish returns. If you had hit the exit button after the initial two years you would have missed the golden years.

In spite of flat returns for the next two years, you decide to stay invested and accumulate more units, hoping that the history will repeat. But, we are hit by a deadly virus COVID-19 and the whole market collapses and erodes gains made in the last few years.

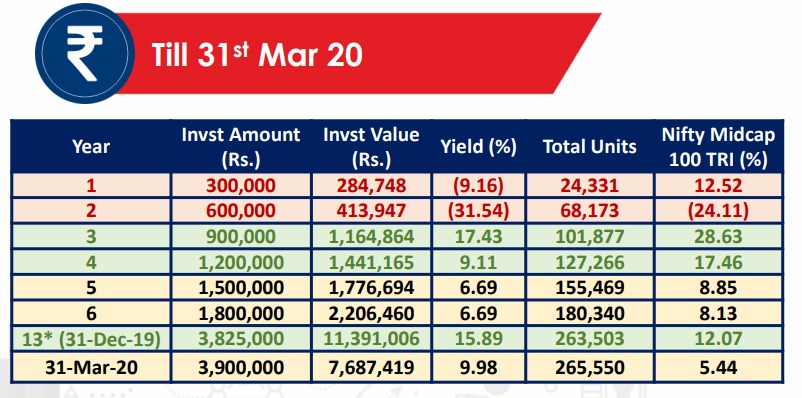

Let’s see the actual returns after our investments was hit by Covid -19

Not bad, we still make 10% which is far better than other alternatives. Notice the yield we make before Covid attack, 16%. Not any great efforts just identify a scheme by applying the framework i shared few days before, invest in that irrespective of market fluctuations, you will surely make returns.

Markets will give Negative returns in the short to medium term, that’s how it has been in every crisis. The current crisis isn’t the first, and won’t be the last. Even during the previous crisis both events saw extended bouts of volatility. And given the market meltdown, SIP returns over the short to medium term were in a similar negative territory as now. You must remain patient and resilient and continue with your SIP to take advantage of the volatile markets. Once we arrive at a medical solution and markets begin to recover, you are bound to reap the benefits of SIP Investments.

I repeat- fortune favours the brave.

Happy Investing!

R♥Vi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Be First to Comment