What? When did this happen, what did they add?

No it’s not about addition or subtraction, it’s all about multiplication, yes i am referring to a famous quote by Albert Einstein on Compound Interest.

“Compound interest is the eighth wonder of the world. He, who understands it, earns it… he who doesn’t … pays it.”

Why did he say that? I will explain you with a story.

A business man’s son approaches his father with an idea of starting a new business hoping to win his approval for financing the venture.

The father likes the idea and gives him 2 financing options

Option 1: Take a rupee now which will get doubled each day for 30 days.

Option 2: Take Rs. 5 Crore now

The choice appeared obvious

The son without any second thoughts goes for the 2nd option as he clearly sees 5 crores now and he can start off immediately.

He does not even consider 1st option as starting with 1 rupee and doubling every day where will he end the month!!!

As promised his father agrees to give him 5 crores but still ask him to closely analyse the first option.

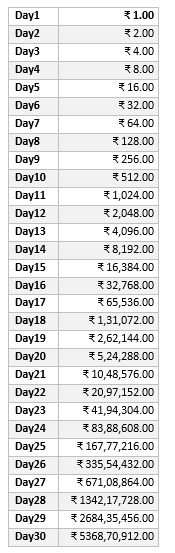

The curious son goes back and works out first option in an excel sheet.

Any guess on how much he will make, well don’t tax your brain, i know, we hate the word TAX, here is the answer:

If you chose option 2, you would lose a cool Rs. 48.5 Crore. A rupee doubled becomes just Rs. 2 the second day, Rs. 4 the third day, Rs. 8 the fourth day and so on. While it seems as if it won’t amount to much, the magic happens from Day 18 when Re. 1 has grown to Rs. 1, 31,072. The money now grows at a rapid pace and in the last 12 days, it goes from less than Rs. 1.5 Lakh to around Rs. 53.7 Crore.

Answer: It pays to be wise with your money and no matter how small the start, it is regular growth that matters.

It is All about Time and Returns

The lesson here is that no matter how small you start, investing can give you great returns later on, with time. While the going may seem slow for the first few years, or even negative, the same small corpus invested regularly can become a handsome pile of cash in later years.

The analogy here when applied to personal finance goes like this. It might take 11 years and 6 months for Rs. 5 lakh invested once at an annual rate of return of 10% post tax to reach a sum of Rs. 15 Lakh. For Rs. 15 Lakh to reach Rs. 25 Lakh (at the same rate of return) will take only slightly more than 5 years.

Baby Steps to Riches

At an early stage most of us do not have the lump sum cash that can show noticeable growth in capital. Small but regular investments ensure that we create the capital required that will give us the really big returns in the years where we might need them the most. A rupee today is more valuable than a rupee tomorrow, but not as valuable as a rupee “invested” today.

Sow today to Reap tomorrow else you will weep tomorrow ♥

Happy Investing!

RaVi

Be First to Comment