Remember the Surf Excel ad, ‘Dirt is good’ , the philosophy here is , if the kids clothes gets dirty in the process of learning something or helping someone then dirt is good. Like wise corrections in the stock markets are very good, if you can stay put during this tough times, your investments will surely yield you more returns.

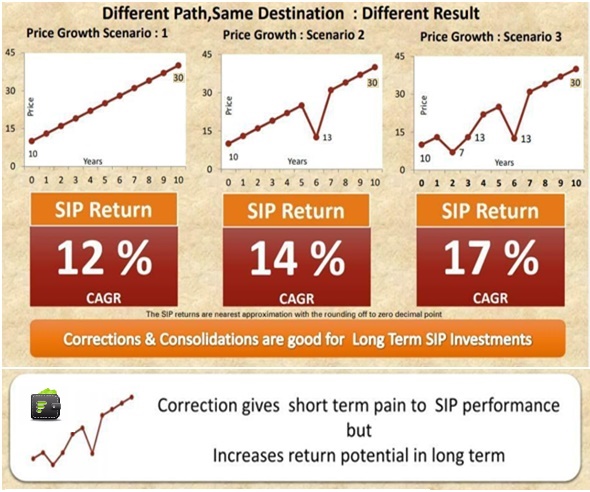

I would like to explain this with a simple example; imagine you start a SIP (Systematic Investment Plan) in a Diversified Equity Fund for one of your long term goal. Assuming the NAV of the fund is Rs. 10 and the fund delivers 12% annualised returns for a period of 10 years, now there are three scenarios, Scenario 1 there is no volatility, the NAV just grows constantly. Scenario 2 there is just one major correction in middle of your tenure. Scenario 3, there are couple of corrections and the NAV jumps like a new born calf.

Which scenario will give you the maximum returns? The fund is same in all the scenarios, only variable is the volatility in the underlying Benchmark /Index. The fund’s nav is Rs. 10 in the 1st year and with CAGR of @12% the NAV grows to Rs. 30 at the end of 10th year. Though we all will be happy with the scenario 1, but the maximum returns is from the scenario 3, provided we stay invested during the corrections.

Corrections are good provided, we utilise the same. We are currently in that situation, surely this is once in a decade opportunity to maximise our portfolio returns.

Happy Investing!

RaVi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Be First to Comment