Well if you have decided to read this post expecting me to discuss some best strategies to build your emergency time, i am sorry. Just thought i will add the word strategy as it has become viral than Corona Virus itself ♥ 🙂

Welcome to FundWallet, i don’t think i will get any better situation than the current one to discuss about how to build an Emergency fund. It is a fund that you can fall back on at the hour of crisis or for unexpected and unplanned scenarios, and not for meeting your routine expenses. Who on earth would have thought about Coronavirus, lock down, so far we all are aware only about Wi-Fi hotspot , but suddenly Covid Hotspot is trending and the whole world is shut for weeks together resulting with countless businesses shut and lakhs of employees out of work. Emergency fund will come out handy in these situations.

How much should i keep as EF? Though there is no concrete formula, but it’s better if you stash away minimum 6 months of your regular expenses as Emergency Fund. If your monthly expenses is Rs. 1 lakh then have minimum of 6 lakhs as EF, don’t worry if the amount is too big to set aside immediately, you can build gradually, but make sure that you won’t invest or splurge your money without building this corpus.

Don’t do social proofing for this, amount what i need, will be different from yours. So don’t go by what other suggests or what you come across in the Financial Blogs including mine. Sit with your family members and decide, the amount might depend on no of people employed, age of the family members and their medical history etc.

Where to keep this EF? It can be kept in multiple products like savings account, fixed deposits and Short Term Mutual Funds. Exigencies won’t come very frequently, so not necessary to keep the entire amount in savings account and don’t look for returns from these investments. You must consider ease of operation and ensure that other family members can also operate this fund. Investing in short duration funds can give indexation benefit too. There is a special product for this, will surely write on that too.

Which is not your EF?

Your Credit Card, though it comes very handy, but with high interest rate and huge penalty for non payment or minimum payment. Credit cards are surely not your EF, if you can pay the entire amount then you can use your Credit Cards.

Your existing investments which are linked to your life time goals. You might be having some investments for your Retirement, kids’ education etc, please don’t touch this, if you have built these investments without creating emergency corpus, please your advisor.

Borrowing from colleagues or friends and the most important your parents.

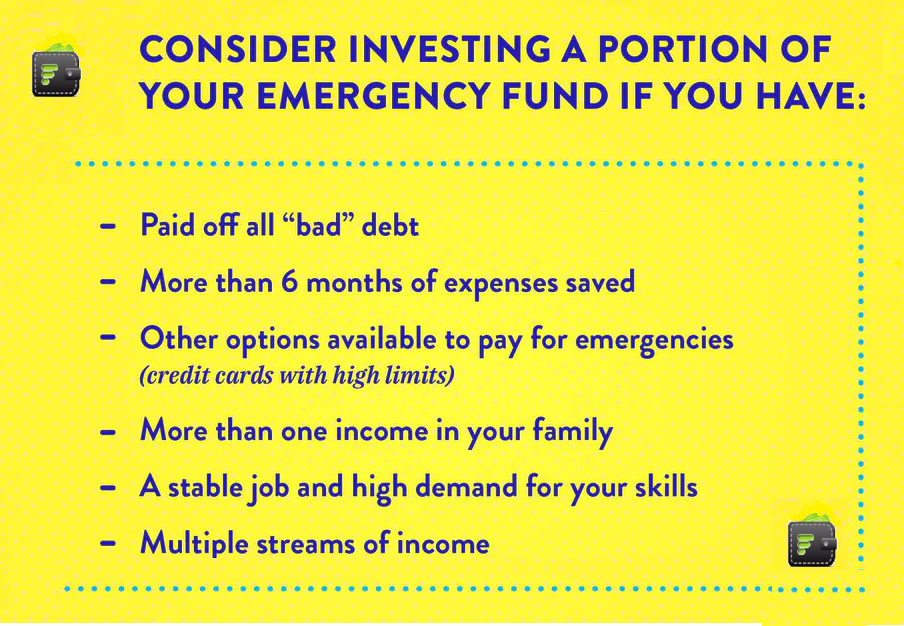

How long should i keep in my EF? Well emergency funds are required throughout your life, but you can consider investing from your emergency fund, if you fulfill the following conditions:

Hope this post would have given you a clear idea about the most important goal in ours life, please revert if you need any more inputs or if you would like to add any other points, you are most welcome.

Happy & Safe Investing!

RaVi

#strategy

Be First to Comment