Debt Funds

Debt Mutual Funds has been hit by Credit & Liquidity virus and due to this Franklin Templeton had to close down 6 of its Debt Funds. The total assets of these schemes are close to Rs. 26,000 crores. What happens to the unit holders? They cannot take their money out, if someone has STP or SWP it stands cancelled.

What has happened is, According to their March ’20 Factsheet, FT has invested lot of their Investors money in low rated papers and due to Covid pandemic, the liquidity dried up for these bonds. Hence huge redemption will make the fund house to sell high rated papers or sell these low rated papers in huge loss. This will lead to more loss to the investors, so they decided to close the fund and return the money to the unit holders as and when they receive the Interest or Maturity payments.

Why did these people invest in these funds? Before that lets come to why Franklin invested in low quality papers that too such a huge allocation. Well unlike equity funds, there is no great way to show out performance in Debt funds as all the funds have almost same basket to pick from. The only way to show performance is to manage the duration / interest cycle perfectly so that they make more money than the category or invest in low rated papers to get extra returns as interest. FT took the second option, though they managed the show very well in the last 8 to 10 years, what’s depressing to see is huge exposure to low rated papers in short term schemes like Low Duration, Ultra short and Short term funds. They were running these schemes as Credit Risk Funds.

Why did people invest their money? So that they get, some extra returns from these schemes. Just to get an extra return of 1 or 2 % they have risked their money. Yes, only this much, that too majority of the investors is in Ultra Short term fund, why would one look for returns in Ultra short term funds or Low duration funds. Typically, these funds are used to keep our emergency funds or funds required in short term, why would someone look for returns from these types, is safety shouldn’t be the first priority. I understand, if someone is looking for returns in equity funds and investing, investing in debt funds by looking at returns is a sin. Debt funds are for CAPITAL PRESERVATION and Equity funds are for CAPITAL GROWTH.

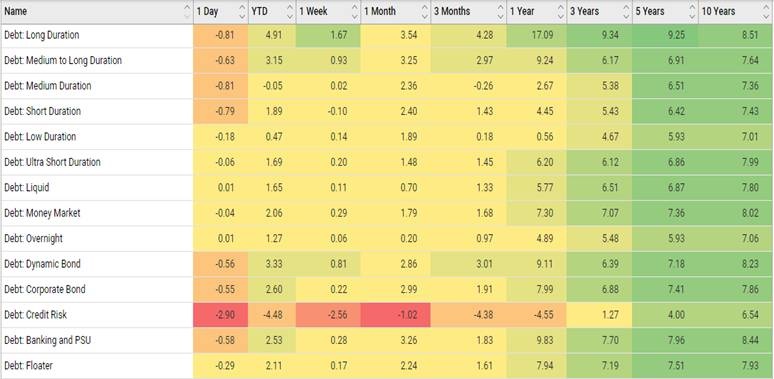

Below is the complete return snapshot of Debt Funds from VR as of 24th April 2020.

As you can see, the divergence in returns across the debt segment is very negligible, so it’s better to identify schemes with good quality papers and invest.

My advice would be, look for some good Ultra Short Term funds or Short term funds and keep your investments. The advantage here is you will save on the expenses, normally long term funds have a higher expense ratio comparing the short term funds. Other advantage is short term funds are less volatile comparing their long term peers. End of the day, you will get almost similar returns and it’s completely not worthy to pay high fees and take more risk ¿

Alternatively, you can also take debt exposure through Hybrid funds or Asset allocation funds, provided your Risk Appetite & Time Horizon approves.. These funds are generally invested for long term and any bad papers in the debt component would not have any major negative impact on the scheme as all these investments are meant for long term.

Please note that by writing this, i am not trying to go up against investing in Long term or Credit risk funds, all i am saying is there are better options available.

Happy Investing!

RaVi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Past performance may may not happen in the future. Data as of 24th April 2020.

Be First to Comment