In the last post, we saw the returns of gold across currencies and also the reason for the recent returns.

In the Long term gold provided returns more than inflation but slightly less than equities, at the same time gold also goes through subdued returns period. What leads to this variance? With superb run over the last one year, what’s in store for the future? What are the factors which decide the Gold Price movement and how are they placed now? Have tried to explain in this post.

Have taken both fundamental & technical parameters that contribute to the volatility of Gold Prices.

Will this kind of stupendous returns continue? While it is very tough to predict the price movement of Equity or Debt in the short term, it’s even tougher with regard to Gold. The principal reason is that there are lot of factors that decides the Gold Rates. Gold plays dual role- both as a commodity and also as a currency. But, over the long term Gold has provided returns above Inflation. Apart from Equities, gold is also a perfect against Inflation. Why? Unlike paper money which can be printed excessively (current situation in US) and injected into the real economy, gold supply doesn’t change much over years. Gold supply has been increasing by approximately 1.5% over the last two decades plus.

What are the Fundamental Factors?

Risk & Uncertainty – triggers the gold price movements. The current tensions between US & China, Trade War etc will surely inflate the Gold Price in USD terms. Gold is considered a safe haven asset – an asset which does well in a crisis scenario or financial turmoil. So whenever there is a crisis usually Gold prices go up as investors flock to Gold given its safety haven status.

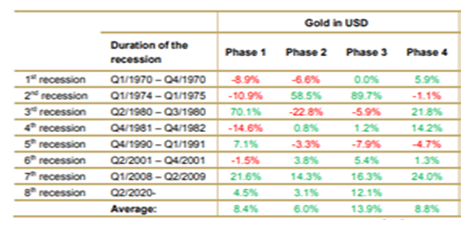

Recession – While there is no doubt that global economies are in a recession, so let’s now take a closer look at gold performance during recessions. Gold, as an event hedge or safe haven, should perform well during recessions. In the table below we look at all recessions in the US since 1970, breaking each one down into four phases:

Phase 1: Pre-recession phase (one quarter before the recession)

Phase 2: Unofficial recession (entry into recession until the official announcement of GDP growth figures by the statistical authorities; assumption: one quarter)

Phase 3: Official recession

Phase 4: Final phase of the recession (last quarter of the recession)

So gold has performed well irrespective of what stage or phase of Recession the US is in.

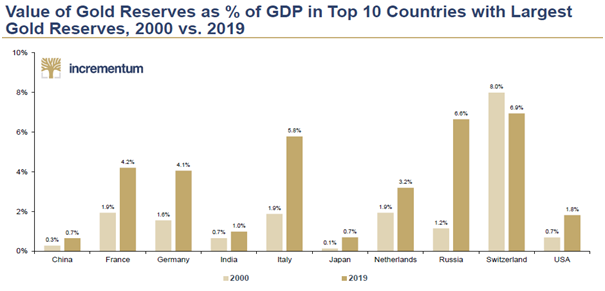

Central Banks across the Globe generate huge demand for Gold. In the recent past, lot of Central Banks have increased their Gold reserve considerably. So except for India, China & Switzerland all other countries have increased their Gold Reserves.

US Real Interest Rates – Historically it has been seen that, when real yields go down – gold goes up, and when real yields go up – gold goes down. Currently the US 10Y yield is less than 1% and the average 10 year inflation is around 2% , so with negative real interest rates, gold is surely going to go up. But why does this happen?

When it comes to safety, global investors have two popular choices – 1) US 10Y Treasury bonds 2) Gold

Now if the real yield of US 10Y Treasury bonds is high then it makes non-interest bearing Gold relatively less attractive and investors would likely want a lower price compared to the long-run estimated real value of Gold. Conversely, when real yields are low and especially negative, investors would likely be willing to pay a higher price relative to the asset’s long-run estimated real value. With all major central banks agreed to go in for Negative Interest Rate Policy (NIRP), the demand for yellow metal is going to rise high for sure.

While the above factors are sure to generate great demand for Gold, but the supply of Gold is a real concern as the average yearly increase in gold supply is just 1.5% over the last few decades. Apart from the above factors, we need to check the Equity market performance as Gold is inversely related to Equities, how USD INR currency combo going to react as that will also count in.

Fundamental Factors indicate there might be more up move in Gold rates in the future. Will share some technical parameters in my next post, till then…

Happy Investing!

R♥Vi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Be First to Comment