In the last post we saw how demand for Gold is created and who are the primary buyers. In this post lets analyse the past performance of Gold and get some insights from the same.

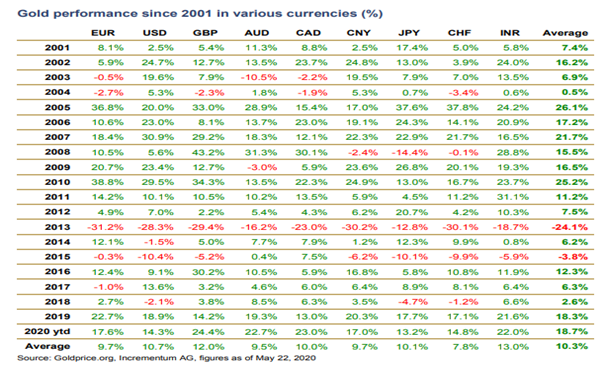

Over the years, gold has given decent returns in rupee terms. Since 2001, gold has given a return of 13% per year in rupee terms, the best among the major global currencies. Over the last 15 years, gold has given a return of 14.7% per year. Over the last 10 years, gold has given a return of 10.1% per year. Over the last five years, it has given a return of 12.8% per year. Of course, a bulk of these returns have come in brief spurts. But that’s the case with stocks as well. Hence, it makes sense to have a part of the portfolio always invested in gold, but at the same time not bet one’s life on it.

The reason for high rupee returns lies in the fact that gold is bought and sold internationally in US dollars. In 2018-19, India produced just 1,664kg of gold. Hence, gold has to be imported in large quantities. In India, gold is bought and sold in rupees. Over the years, the rupee has consistently lost value against the dollar and that spruces up the rupee returns of gold. With the country entering a difficult economic period, the chances of the rupee continuing to lose value against the dollar remain very high and gold is likely to benefit from that.

Gold Returns (in INR) = Change in Gold Price (USD) + ~3-4% from INR depreciation vs USD

The above chart is the price of gold in various currencies,

So, over the last two decades, gold in INR terms has given average returns of 13%, with two years of negative returns, and few Flat or single digit returns.

What are the fundamental factors which drives the gold rate will be discussed in the next post.

I am not giving any recommendation as i am not an expert in analysing Gold, but for the purpose of Asset Allocation, it’s advisable to have 5 to 10% of your portfolio in Alternate Assets like Gold.

Happy Investing!

R♥Vi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Be First to Comment