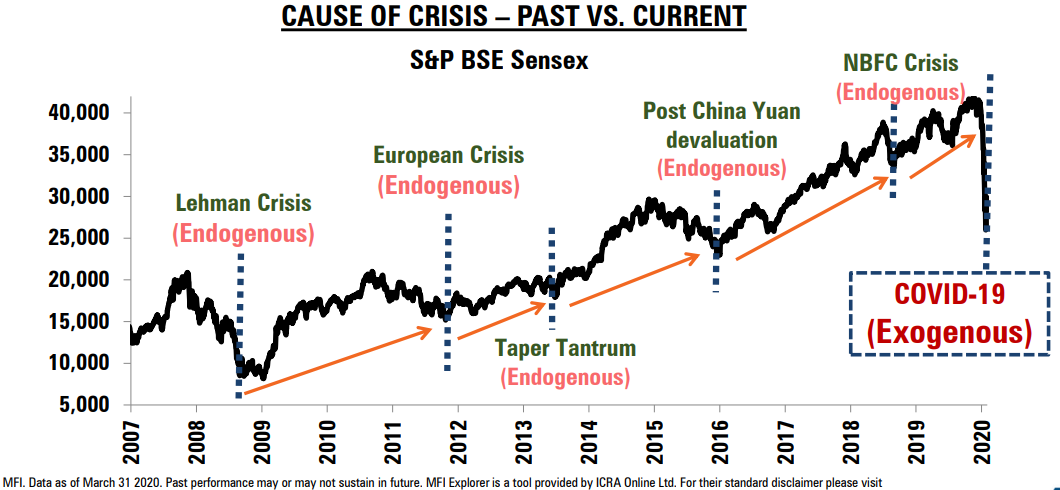

Coronavirus is having a strong impact on the world economy. Many comparisons have been made between the coronavirus crisis and the other crisis like Lehman or European crisis, and how markets or the economy have bounced during the previous ones. Though there are certain similarities like Bankruptcies, mounting job losses but this time it’s completely different. Let’s us see why?

Basic cause of Risk can be of two types one is Endogenous and the other one is Exogenous. Exogenous risk arrives to the financial system like an asteroid might hit earth – it comes as a surprise, there is nothing we do to precipitate its arrival. It arises outside the ambit of the country’s Economic or Financial factors. And it can cause enormous damage to the financial system, the coronavirus shock is purely exogenous.

The 2008 Lehman crisis was caused by the Market Participants, the decision to sell similar assets to avoid same risk exposure and causing liquidity crisis. When a financial crisis or Economic crisis is caused by some internal factors then its termed as Endogenous Crisis.

The corona virus is an pure Exogenous crisis, as both production and the consumption is severely hit. The recovery is purely depends on how quickly we discover a vaccine or flatten the Virus curve and how soon we come out of this pandemic. Once we come to this stage, we can guess when the demand will start and what kind of products or services will see quick revival, what growth rate the economy can achieve etc

But the stock markets are in different zone, though we saw some demand for certain goods coming back to Pre Covid period but its more of a Pent up demand and not the regular one. Pent up demand refers to a situation when demand for a service or product is unusually strong and in Economic parlance the term is describe as the general public’s return to consumerism following a period of decreased spending.

How markets have fared during the previous crisis and the current one:

Though the Government and the Central Bank has taken the stimulus steps to prop up the growth but we need to see how effective the policy will be to create demand back. Till that time, it’s better so watch the markets on the sidelines. But, the current market creates a big opportunity for the Momentum Investors or Traders who can play on both sides for Investors, it’s time to slowly build your long term portfolio in a staggered manner.

Happy Investing!

R♥Vi

Disclaimer: The information contained in this document is for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should seek appropriate professional advice. Past returns are not guaranteed. Source of chart- ICICI PRU MF.

Be First to Comment