One of the main reasons that lead investors to fall miserably is that their expectations don’t match reality. This is not only with Investment world, even in real life we tend to get bogged down by this Expectation vs Reality Trap.

The biggest problem in life is the Image in our Head on how certain things should be. We assume how certain things or activity should be and when we fail to see or experience it we feel agitated and completely exit from that scene. We don’t even try to analyse what went wrong or how to set it right.

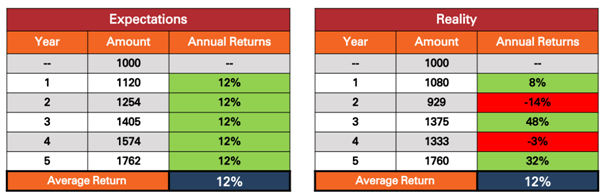

When we start investing in Equities or Mutual Funds, we set certain returns target based on the past performance. Though that particular investment will be on track but the path will be very volatile.For example,before investing we might expect our investments to generate 12% annualised returns,but in reality though we might achieve our target returns but it wont be a smooth ride.So if we don’t get the set returns in the initial years we should not exit the plan rather analyse whether we are on the correct investment and stay Invested.

Some of the common Expectations of Investors and the Reality are mentioned below:

Expectation: Investing Will Make You Rich Overnight

Reality: Investing can make you INCREDIBLY wealthy, but it probably won’t happen overnight. Compounding interest takes time to build up, and Equities rarely skyrocket in value over the short-term.

Expectation: When You Purchase a Stock it Will Only Go Up

Reality: This doesn’t happen with every company. And it that happens, you have to immediately exit from that stock. Stocks should be volatile then only we can make money. Imagine stock going up continuously you will exit investments completely.

Expectation: Once the Investing done You Won’t Have to look at that Anymore. It will automatically grow.

Reality: Investing will allow you to have a comfortable, happy life no second thoughts on that. But you need to monitor the same regularly.

It’s true that there is no “sure thing” in the stock market, but there are investing strategies that can greatly lower your risk and increase your chances for high returns.

Consult a Investment Advisor to set your expectations right in the initial stage itself.

Happy Investing!

R♥Vi

Be First to Comment