Few posts away, we saw some details about Atmanirbhar Scheme of Mutual Funds, if you have missed reading it please click Aatmanirbhar Scheme. Now what is the performance of these schemes during various Market Trend Periods.

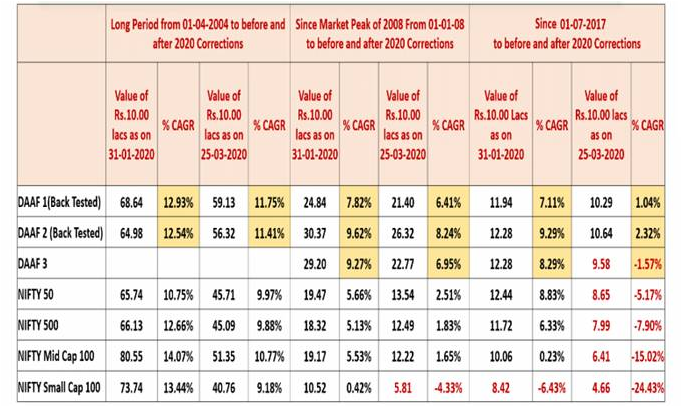

Let’s see how investments in some of these schemes under different time periods have performed. Have taken three scenarios:

Scenario 1

- From 01-04-2004 to 31-01-2020 and 25-03-2020 – Long enough period, which has witnessed two big up trend, few small down trends, two Big fall and reasonable time of Non trend period.

Scenario 2

- From 01-01-2008 to 31-01-2020 and 25-03-2020 – from peak of Market in January 2008 to before and after Market crash of 2020

Scenario 3

- From 01-07-2017 to 31-01-2020 and 25-03-2020 – This period is more of a non trend as most of the stocks were correcting or didn’t move much apart from few large cap stocks contributing to the Index Up move.

All the scenarios have two different end dates, one before the Covid Crash and one after the low formed in Markets (23rd March 2020).

So, Balanced Advantage Funds have performed on par with Small & Midcap index during bull trend, at the same time it has arrested the fall of its NAV during this Covid pandemic fall. These funds will under perform Multicap or Large& Midcap funds during the Bullish trend, during tough times or any major fall it performs better than any other Diversified Equity Funds.

When the market goes up your investments will be on par with the broader indices and when the market goes down your investments will fall less, in-fact much lesser than the broader indices.

⇑Happy Investing⇑

R♥Vi

Disclaimer: The information contained in this document is for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should seek appropriate professional advice. Past returns are not guaranteed. Source of Performance Image- MrBond website.

Be First to Comment