After four rounds of economic stimulus announcements by the Finance Minister as part of the government’s Covid relief efforts, financial markets are still unimpressed as they feel these measures are “medium to long term in focus and will not address the demand destruction and cash flow disruptions businesses are facing.” Thereby, they may not be an important driver for the market that we are waiting for. At best, stocks of specific companies might see some enthusiastic action.

What the government announced is more of reforms rather than stimulus, stimulus is to increase government spending when the economy is struck in a recession as during these times due to low confidence there will be bigger fall in public spending, therefore the government should borrow and spend as this can help kick-start the economy and provide recovery. The measures announced will certainly have a positive impact but not immediately, to save from the current situation Govt should have just IMHO Given 2500 pm to 25 cr jan dhan accounts for 6 months with free PDS ration, Give 25 % GST and 25% ITax waiver to business and taxpayer for one FY. Provided capital at 2-3 pct will full collateral to MSMEs for one year. These will spur the demand at the same time provide necessary liquidity to MSMEs for their working capital. This will increase our borrowing and surely impact our Fiscal Deficit buy this is not the time to worry about Deficit. Give more money and create demand increase turnover of companies and increase your tax revenue. This is just my opinion, i may be completely wrong too, but they should have tried something simple instead of all these long press conferences and big announcements etc.

“If you buy a pack of wafer chips like Bingo or lays, that packet will have upto 70% air and 30% chips, the current stimulus package is exactly the same”

Ok, let’s come back to what’s the news with the financial markets. As usual it’s not easy to predict the markets in the short term, but if we look at the history of financial markets, i can say with confidence that in the long run markets will reward us with handsome gains if we are patient enough and sail through this turmoil. I am reading more History now than what i have studied during my school days ⊗.

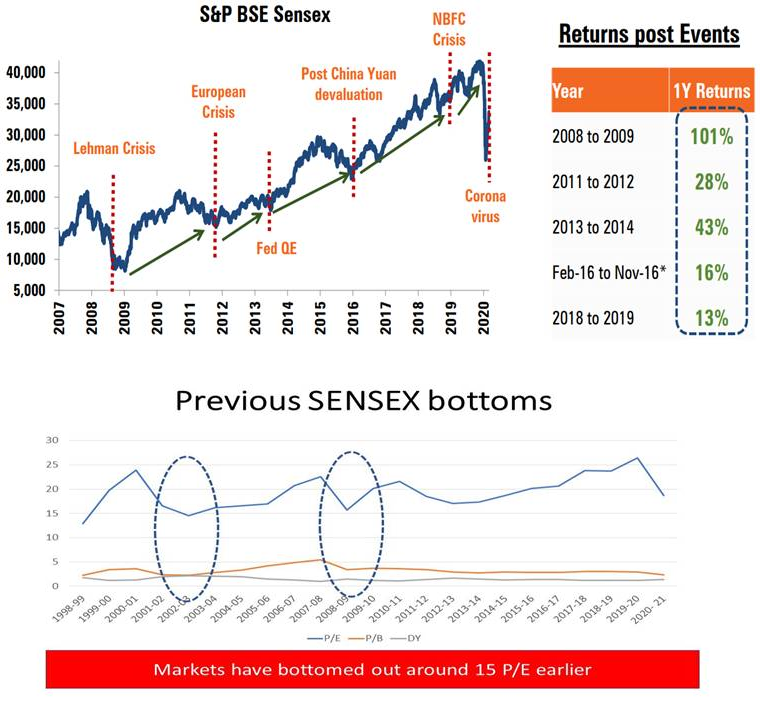

Every Crisis has been an opportunity in the past.

Sensex has bottomed out around 15 P/E twice over the last two decades, also the Price to Book and dividend Yield of the index came kissing each other both the times. While the gap between P/B and dividend Yield is very much less, the P/E is still slightly high and we might see another bout of correction before risk reward comes in favour of Equities. This is just my observation, i might partially / fully enter equities around 8000 Nifty levels based on how the Covid impacts and how good the economy comes back to operation. And strongly feel that for long term investors that is a most attractive level one could get.

On the Debt side, the measures announced so far are expected to have a far lower-than-expected impact on the government’s fiscal deficit. This is BIG positive for the debt market. Short term parking for STP into equity can be invested in Ultra Short term funds, and if you have a longer time horizon of 3 years plus, you can look at Dynamic Bond funds or Corporate bond funds with slightly higher average maturity. Banking & PSU debt funds if you want safety plus average returns.

The measures taken now will surely have a positive impact on the economy in the next 18 to 24 months and the stock markets even earlier than that, as market returns are always front loaded and will be very happy if markets throws surprises on the positive side and proves me wrong. I am bit pessimistic currently for the short term, as we are surrounded with lot of uncertainties, but as lot of other countries are planning to cut their trade deals with China, shift their base to other Asian countries, i am sure we can go a long way even if we get 15 to 20% of those investments.

Happy Investing!

RaVi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Be First to Comment