The current slump in the Equity market has provided a great opportunity to invest for the long term. Past history suggests that, after every deep correction markets has not only returned to its previous high, but also made new highs. To make use of this opportunity, i would suggest you to look into this fund which has lot of unique features comparing its peers.

Parag Parikh Long Term Equity Fund is a diversified equity scheme. It is a local fund with a global focus. This is one of only a handful of Indian mutual fund schemes to invest in a basket of Indian & Foreign stocks. Its investment universe is not restricted by any self-imposed limitations in terms of sector, market capitalisation, geography, etc. However, an average of 65% of its corpus will be invested in listed Indian equities, in order to benefit from the favourable Capital Gains tax treatment accorded to such schemes.

This scheme is only suitable for ‘true’ long term investors….Who are they?

- Who knows the perils involved in instant gratification

- For whom the term ‘long term’ means a minimum period of five years.

- Who gets excited rather than repelled, when stock prices and valuations are low.

- For whom purchasing a stock is no different from purchasing a business.

We will follow a simple (though not simplistic) investment process. As we will not pay mere lip service to value investing, it may mean that often we will be purchasing businesses which are going through a painful phase and are therefore unloved. Each of them will blossom at different points and that is why, there may be extended periods when you may feel that ‘nothing is happening’. While some may regard us as boring, we are adamant that we will never sacrifice prudence for the sake of providing excitement. Also, the fund managers will attempt to profit from various cognitive and emotional biases displayed by companies and market participants. In other words, along with the dissection of financial statements, there will also be an overlay of the study of human emotions.

Portfolio Strategy:

A proven value investing strategy, with global exposure that suits long-term investors.

Searching for value in India and globally

The fund invests in value stocks (those trading below their intrinsic value) from across Indian and global companies. It chooses stocks across market cap depending on where valuations are attractive.

Global exposure diversifies risk

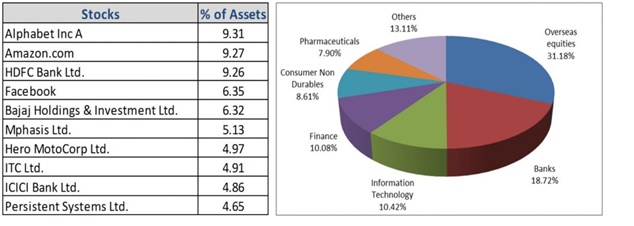

The fund’s exposure to foreign securities helps diversify country-specific risk. It also gives investors the opportunity to invest in companies (such as Facebook, for instance) that may not have Indian counterparts. It can invest up to 35% of its corpus in foreign equity securities.

Buy and Hold Philosophy

The fund follows a longer-term approach via the ‘buy and hold’ strategy. Nearly half of the fund’s corpus was in stocks that it had held for a minimum of 4 years plus. This approach is also reflected in the low portfolio turnover ratio of 5.85%.

Concentrated portfolio

The fund holds a concentrated high-conviction portfolio of a few stocks that are not churned frequently. The top 10 holdings accounted for 52% of its corpus.

Some Unique Features:

- The fund scores high on investor communication. It’s the only Mutual Fund Company which holds annual review for its Unit Holders.

- Skin in the Game – Promoters and the fund management team also invest in the scheme thereby ensuring higher accountability.

- The fund offers only Growth Option & not Dividend option, which helps to bring in the effect of compounding for our investments.

Why invest in this fund?

- Proven Investment Strategy – Parag Parikh Long Term Equity Fund adheres to the value style of investing and selects stocks across market cap (large, mid and small-sized companies). It follows the buy-and-hold strategy and manages a concentrated portfolio of a few high-conviction stocks.

- Global Exposure: The fund’s exposure to global stocks provides investors with a hedge against country-specific risk.

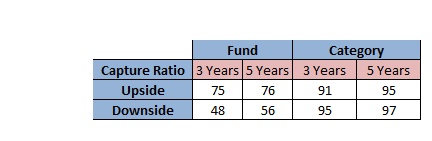

- Minimizes Downside Risk– The fund has been successful at reducing downsides. That is, it has performed better than its benchmark, Nifty 500 TRI in periods when the markets fell. This is possible as the fund takes cash calls when pricey valuations make it difficult to find suitable investment opportunities & the fund manager’s ability to buy stocks at reasonable valuations and is therefore able to limit the downside (from thereon) effectively. This is rightly captured by the Downward Capture Ratio which provides a fund’s ability at containing downsides. A value less than 100% indicates the fund has captured less of the downside in periods when the markets fell. Lower the ratio, the better it is.

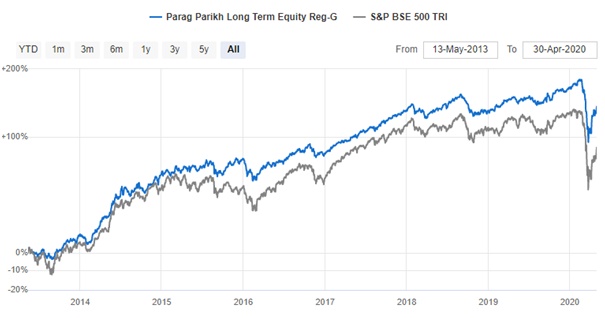

- Consistent performance – The fund has consistently generated above average rolling returns compared to its peers and it’s Benchmark.

This scheme is not for you if…

This scheme is not for you if…

- You track mutual fund Net Asset Values every day.

- To you, the term ‘Long Term” is merely a year or two.

- You believe that investing should be ‘exciting’

- You fear, rather than welcome, stock market volatility

- You believe you have the ability to time the market

- You prefer complex mutual fund products to simple ones.

- You depend on periodic income in the form of mutual fund dividends

because, most likely, you will be disappointed!

This fund is a must for any genuine long term investor.

More details about the fund can be viewed here (https://amc.ppfas.com/schemes/parag-parikh-long-term-equity-fund/)

Happy Investing!

RaVi

All efforts have been made to ensure the information provided here is accurate. However, no guarantees are made regarding correctness of data. Please verify with scheme information document before making any investment. Certain information has been taken from the PPFAS website and some from external sources like VR, Morningstar.

Be First to Comment