Corona crisis has hit us all hard. Nobody could predict the scale of this crisis. Market reaction has been steep. Markets across the world crashed, US stock market which had hit a 52-week high in Feb’20 crashed 31% to hit a 52-week low in March. The speed of the fall was unprecedented as global markets went from 52-week high to 52-week lows in less than a month. Emerging Markets (EM) have fallen in line with Developed Markets (DM) (around -23% each). But the fall in individual EMs is much higher – the overall index numbers look better on account of the large weight of China which has fallen only 10%. Imagine China fallen just half of the average EM indices.

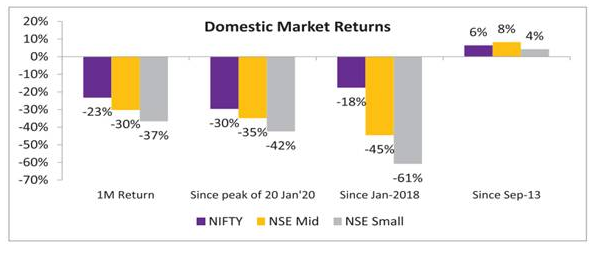

Domestic Markets too witnessed a sharp fall, with the NIFTY crashing 38% in just 20 trading days, one of the sharpest fall ever. Though, initially, mid and small cap indices fell in line with the NIFTY, NIFTY recovered towards the month-end, whereas the broader markets continued to languish, resulting in significant gap in 1M performance between the NIFTY and broader markets. From the peak of Jan-18 NIFTY, NSE Mid Cap and NSE Small Cap have fallen 29.7%, 34.9% and 42.4% respectively. Interestingly, markets are now at levels close to the Sep-13 bottom.

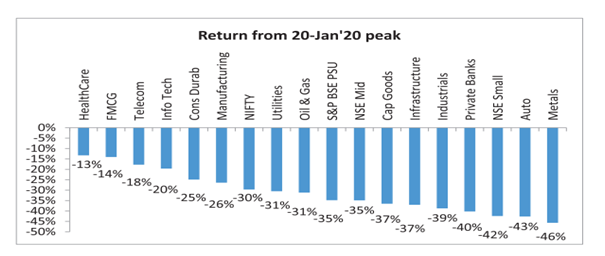

Sector wise downfall:

Private Banks and Consumer NBFCs have been the biggest casualty of this correction – and have fallen more than the market and even PSU banks. Growth for these banks in the recent past was driven by a surge in retail loans and working capital credit. After the NPA concerns for Corporate Lenders over the last few years, given the sharp dislocations seen in the real economy due to COVID-19, fears of NPAs from the unsecured retail book have spooked investors.

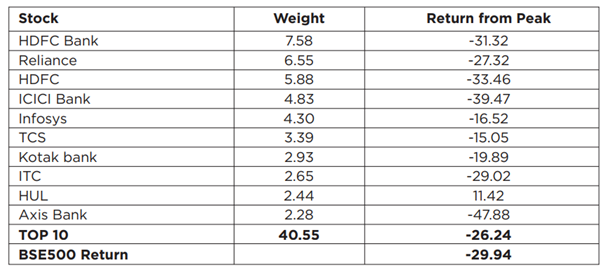

Top 10 stocks fall in line with the market: Since Jan-18, markets have been highly polarized with the top 10 stocks significantly outperforming the broader markets. In this correction though, the top 10 stocks have fallen in line with the broader markets, some higher than the broader markets – HUL, the only positive among the top 10 whereas all three banks fell more than the market.

What Next?

Virus is going to dictate the timetable of normalcy and thus forecasting corporate earnings has become difficult with existing earnings estimates facing sharp downside risks. Clearly, this quarter will be a quarter like no other, perhaps globally.

Investor Strategy: Given the sharp fall in the Nifty over the last month and the two years long bear market in Small Caps as well as Mid Caps, market valuations are at very attractive levels. However, given the “uniqueness” of the situation, the earnings growth recovery could be uneven and unpredictable. Without any medical solution to the medical problem posed by the novel corona virus, market volatility could remain high – sharp falls followed by short surges. The current price correction may appear to look attractive and especially in case of individual stocks, but, buying solely on the basis of %age drop from the peak could be a poor strategy. Please keep in mind other variables like – leverage; Estimated Revenue drop’ Management perception etc – which make a company attractive based on its “fundamentals” and not driven solely by the “Price” factor.

It is quite likely, that a medical solution would change the market mood overnight and results in a frantic rally. Chasing such a rally would depend on how long the economy has been held prisoner by the novel Corona Virus. If such a development takes place within the next fortnight to a month, then going “all in” may be a good strategy. If the current uncertainty lingers till the end of June quarter, then the economy may be bruised but not damaged and markets may probably take a few quarters to recover.

The Silver Lining:

- India is a domestic-driven economy and dependence on exports is low.

- Current account, Inflation, Forex reserves are comfortable. Additionally, low oil prices and interest rates will help during recovery.

- Owing to low crude prices, India’s trade deficit narrowed to $9.85bn in February

- India is a services-oriented economy, which would mean bounce-back will be faster.

Will remain hopeful that, we will emerge from this pandemic with sound health in body and mind, and commit ourselves to staying the course in our investment journey, through this very difficult time J who knows, this could well end up being one of the best investment opportunities for the next decade!

Happy Investing! Stay Home, Stay Safe.

RaVi

Disclaimer: The information contained in this document is compiled from third party and publically available sources and is included for general information purposes only. Views expressed cannot be construed to be a decision to invest. The statements contained herein are based on current views and involve known and unknown risks and uncertainties. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice.

Be First to Comment